One of the familiar themes seen in previous crypto market cycles is the shifting market caps, popularity and ranking of the top 10 projects that see significant gains during bull phases, only to fade into obscurity during the bear markets. For many of these projects, they follow a recognizable boom-to-bust cycle and never return to their previous glory.

During the 2017–2018 bull market and initial coin offering (ICO) boom, which was driven by Ethereum network-based projects, all manner of small smart contract-oriented projects rallied thousands of percentage to unexpected highs.

During this time, projects like Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR) and ZCash (ZEC) also rotated in and out of the top 10 ranking, but to this day, investors still argue about which project actually presents a “useful” use case.

While all of these tokens are still unicorn-level projects with billion-dollar valuations, these large-cap megaliths have fallen far from their previous glory and now struggle to stay relevant in the current ecosystem.

Let’s take a look at a few of the current projects that threaten to unseat these dinosaur tokens from their perch.

Dollar-pegged stablecoins take the stage as the most “transactable” currency

Bitcoin’s (BTC) original use case stipulated that it would simplify the process of conducting transactions, but the network’s “slow” transaction time and the cost associated with sending funds makes it a better store of value than a medium of exchange when the other blockchain networks are considered as options.

Terra (LUNA), a protocol focused on creating a global payment structure through the use of fiat-pegged stablecoins, has emerged as a possible solution to the issues faced when trying to use the top proof-of-work (PoW) projects as payment currencies.

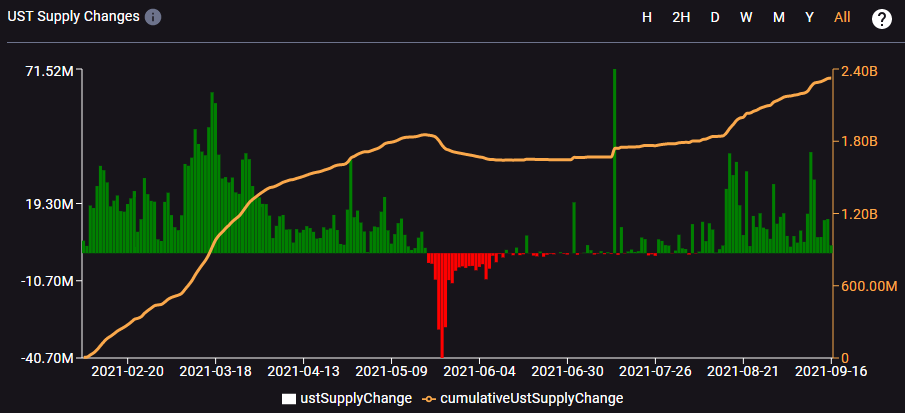

The main token used for transacting value on Terra aside from LUNA is TerraUSD (UST), a U.S. dollar-pegged algorithmic stablecoin that forms the basis of Terra’s decentralized finance (DeFi) ecosystem. The market cap of UST has steadily been increasing throughout 2021 as activity and the number of users in the ecosystem increased.

The recent addition of Ether (ETH) as a collateral choice for minting UST on Anchor protocol has given token holders a way of accessing the value in their Ether without having to sell and create a taxable event.

This opens the possibility for other tokens such as BTC to be utilized as collateral…

Click Here to Read the Full Original Article at Cointelegraph.com News…